Choosing a career seems to be a question quite in vogue of late. Everyone is on the lookout for a successful and fulfilling career. This, in turn, helps them become independent and chart their path in life. And we at Totempool decided to shed light on the varied choices available. So, we started our ‘Good career path’ series. This piece is another excellent research content and aims to answer the question – Is finance a good career path?

Let’s give you our opinion might away.

Yes, finance is an excellent career path. A career in finance offers diverse opportunities for growth and development and is often seen as the gateway to success.

With solid corporations in finance and top-paying jobs, the field is a must-go for those looking for challenges and returns.

Let us find out more in detail.

Table of Contents:

- What Are The Streams of Finance Available?

- Five Questions to Ask Yourself Before Pursue a Career in Finance

- Certifications and Licenses

- What Finance Career Is Right For Me?

- What Finance Career Involves The Stock Market?

- Is Finance a Good Career Path For Students?

- Is Finance A Good Career Path?

What Is Finance?

Finance is the study of how individuals, businesses, and governments manage their money. It involves analyzing financial data to make informed investment decisions, budgeting, risk management, etc. The field of finance also covers various specialized areas such as corporate finance, investment banking, asset management, and financial planning.

While a finance career can offer high-paying salaries and opportunities for growth within an organization, it often requires long hours of work under tight deadlines. Additionally, jobs within the industry may fluctuate with market conditions or economic cycles, leading to job insecurity for some individuals.

Overall, whether you consider a career in finance to be a good fit for you ultimately lies in your personal preferences and goals. Factors such as your passion for analyzing complex data or interest in understanding global economies may influence your decision to pursue this path. However, if you possess strong analytical skills coupled with an entrepreneurial mindset that thrives under pressure and constant change, finance could be your right choice!

What Is Considered A Good Career Path?

Looking beyond salary and job security is important when considering what makes a good career path. A fulfilling career should provide growth, learning, and personal satisfaction opportunities. It should also align with your interests and skill set. Finance as a career path can be rewarding for individuals who enjoy working with numbers, have strong analytical skills, and are interested in the workings of financial markets.

However, it is important to note that finance can be demanding and requires long work hours and high-stress levels. It may not be suitable for individuals seeking flexibility or work-life balance. Additionally, the field has faced controversy regarding ethical practices in recent years.

Whether or not finance is considered a good career path depends on individual preferences and goals. While compensation can be attractive in this industry, it should not outweigh considerations such as personal fulfillment ߝ both professionally and ethically, when making decisions about one’s future career path.

What Are The Investments Needed For a Good Finance Career Path

A career in finance requires a strong foundation of knowledge and skills. Formal education is the starting point for this path, with undergraduate degrees in accounting, finance, or economics being popular choices. Pursuing an advanced degree such as a Master’s in Business Administration (MBA) can increase earning potential and enhance job prospects.

Beyond formal education, individuals must possess other essential qualities such as attention to detail, critical thinking skills, and working well under pressure while meeting tight deadlines. Participating in internships or mentoring programs with established professionals can also provide practical experience that will help to differentiate candidates within the competitive field.

Demonstrating expertise through relevant certifications, such as Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP), can bolster client credibility. Building a successful reputation requires integrity and trustworthiness, earned over time by providing excellent services and maintaining ethical behavior within the industry.

History Of Finance Career Until 2023

The history of finance as a career field has been intertwined with the growth and evolution of global business. From the early days of trade and commerce, financial professionals have played an essential role in managing funds, analyzing risk, and generating profits for individuals and organizations alike.

The birth of modern banking in the 19th century led to new opportunities for financial experts who could navigate complex markets and adapt to changing economic conditions. As technology advanced, so did the tools available for forecasting market trends, making informed investment decisions, and performing complex transactions.

Looking towards the future until 2023, it’s clear that finance will continue to be a crucial component of global commerce. While traditional roles such as stockbrokers or accountants might experience some decline due to increasing automation, the demand for skilled data analysts and financial advisors is expected to rise rapidly.

With ongoing globalization and technological innovations shaping up our world, Fintech companies are accelerating growth more than ever before. As industries strive towards sustainable solutions, economic activities are becoming more diverse; Finance professions also need diversified knowledge and ethical considerations. Thriving at present many institutions have started developing programs on Financial Ethics. The near future surely holds unlimited potential in this historic profession full of diversity, potential, and excitement.

What Are The Streams of Finance Available?

The first step towards understanding the answer to – Is finance a good career path? – is to understand the different streams available and what would be the right career for you. There are four significant streams of Finance. We shall explore them in some detail below:

Investments

Committing money or capital to buy financial instruments is known as an investment. Additionally, one can use capital to purchase assets such as real estate.

One invests to earn returns through earning, interest, or value appreciation. Investment is a method to delay spending.

Financial Institutions

These are institutions that collect funds from the public. The financial institution, in turn, puts this money in deposits, loans, or bonds rather than tangible property.

International Finance

This branch of financial economics is focused on the macroeconomic and monetary relations between countries. It examines the dynamics of balance of payments, floating exchange rates, foreign direct investment, and their effects on international trade.

Corporate Finance

Corporate finance deals with the capital structure of a corporation. These include decisions such as funding sources, accounting, and investments. The end goal here is to enhance the value of the firm. Allocation and prioritization of resources also fall under corFinancefinance.

Five Questions to Ask Yourself Before Pursue a Career in Finance

Often enough, the fancy salary figures thrown around in the media sway the minds of young people looking to pursue a career in Finance.

However, one must always perform due diligence before making such important decisions. Here are five questions one must ask before choosing a career in Finance, and these will help answer the question – Is Finance a good career path?

What Does A Career In Finance Entail?

Number crunching on excel sheets is integral to finance. But, pursuing a career in this field involves plenty of other aspects, such as:

- Excellent written and verbal communication skills

- The ability to persuade others

- People management

- Negotiation

- Legal knowledge

An individual can’t alienate himself from these. Hence, one must bear in minFinancefinance is an all-encompassing sector. So, it is essential to have a holistic approach.

What Draws You To Finance?

There is a lot of information that is readily available these days. So this leads to several assumptions about the kind of career one might hFinancefinance. Yes, this is an ideal career if one loves numbers and money or enjoys the volatility of the markets.

But given the width of careers that finance offers, one must remember that working in investment banking is entirely different from working in commodities trading.

What Are Your Strengths?

Before deciding on a career in finance, one must clearly understand their strengths. Are your strengths suited to a career in Finance, and will they be used well?

To summarize, a person must ensure that a career in Finance aligns with their strengths. For instance, if one is creative, Finance might not be the area for them. Also, if a person is more inclined towards looking at the larger picture rather than, the finer details, he is better suited to a career in strategy.

What Do You Wish For?

The decision to pursue a career in Finance must be yours and yours alone, and it must not be a result of societal pressure or herd mentality. Therefore, one must ensure this decision is in sync with the end goals.

Is a person looking for excellent career growth opportunities and willing to sacrifice work-life balance in the short term? The answer to this question depends purely on what you expect from the job.

What Are Sunk Costs?

This is a question that will make sense if you are switching to finance from another career stream. It would be best to analyze whether the efforts and energies invested while hitting finance are worth it.

Once you have satisfactorily answered these questions, you can enroll in some courses online to get a flavor of the subjects to understand if Finance is the right career path for you.

Certifications and Licenses

A bachelor’s degree in Finance is considered the bare minimum for any finance job. However, additional certifications and licenses are a way of proving to your potential employer that you are willing to go the extra mile. In this section, we shall look at some reputed certifications in Finance.

Chartered Financial Analyst (CFA)

This is one of the most recognized qualifications that financial professionals have. However, it is restricted to banking and Finance. This is an ideal degree for those interested in a career in asset management, investment banking, private equity, or hedge funds.

To complete the CFA qualification, one must pass three generally considered complicated and tricky examinations.

Additionally, one needs 48 months of investment or banking-related experience in a full-time role. People who complete the CFA have a firm grounding in equity investments, corporate finance, derivatives, financial reporting, and portfolio management.

Financial Risk Manager (FRM)

The FRM designation is an international risk certification offered by the Global Association of Risk Professionals (GARP). The topics covered in this exam are tools for assessing financial risks, such as financial markets, risk modeling, quantitative analysis, and valuation. Career options for FRM professionals include Chief Risk Officer, Senior Risk Analyst, and Head of Operational Risk. To complete this certification, one must:

- Clear both levels of the exam

- Have two years of relevant work experience

- Be a member of the GARP

- Complete 40 hours of CPD training every two years

Certified Financial Planner (CFP)

This is a certification that requires one to have a bachelor’s degree with finance-specific coursework. Additionally, one must possess 6000 hours of financial planning experience or 4000 hours of apprenticeship experience. And one must pass a grueling 6-hour exam to be certified.

Chartered Market Technician (CMT)

The CMT is a globally recognized specialized certification focused on the technical analysis of investments. So, it helps one create a unique profile with technical and financial analysis expertise. Moreover, a person must hold a CMT membership and agree to its code of ethics. This is a three-level exam.

Certified Public Accountant (CPA)

This exam prepares you for careers in public accounting, managerial accounting, and tax planning and preparation. Also, it enhances avenues for higher-paying careers in accounting and management. This exam requires a degree or 150 credit hours in accounting or Finance.

In some states, one must also have a Social Security Number or US citizenship. It has four parts – auditing and attention, business environment and concepts, financial accounting, and auditing. The last part of the exam is regulation.

Certified Management Accounting (CMA)

Management accountants are essential to determine financial metrics that help their daily operations. Pursuing CMA requires a person to have a bachelor’s degree.

Additionally, one needs to have at least two years of work experience and be a member of the Institute of Management Accountants (IMA). The exam consists of two parts. Part 1 consists of financial planning and analysis, and part 2 deals with strategic financial management.

Chartered Alternative Investment Analyst (CAIA)

This designation is meant for individuals working in the alternative investment space, such as hedge funds and private equity. It is also helpful for people in less traditional roles, such as derivatives or trading desks. One has to clear a two-level multiple-choice examination to earn this certification.

Chartered Investment Management Analyst (CIMA)

The CIMA certification covers asset allocation, risk measurement, due diligence, risk measurement, and investment policy.

Since this is a specialized certification, only persons with at least three years of professional consulting experience can take this up. CIMA requires continuous re-certification and training of at least 40 hours every two years.

Roles in Finance: What Finance Career Is Right For Me?

We have now arrived at the most critical parameter to answer the question, Is finance a good career path? Let us look at some of the parts that the finance sector has to offer. The breadth of the career roles provided.

Actuary

Actuaries are best suited for a corporate finance career, and an actuary’s national average salary is around $125,000. These professionals utilize their knowledge to measure the livelihood and severity of the risk. They also can predict and minimize the impact of upcoming risks, and this is an ability that is extremely useful for businesses.

Financial Analyst

Financial analysts use their research skills and knowledge of securities to advise firms on their investment decisions. They measure the risks and approve or reject investments in stocks, bonds, and other securities. Also, they forecast the company’s ability to repay its debts by including bonds. Financial analysts typically make $74,000 a year.

Financial Accountant

This professional keeps track of the company’s reports. They primarily deal with a company’s financial statements. These include the profit and loss statement, balance sheet, income statement, and cash flow statements.

A financial accountant earns more than $63,000 a year. Additionally, they record every transaction and maintain the accounts of a firm. They are also responsible for keeping track of overall investments in various projects.

Investment Banker

The role of an investment banker is highly versatile. They help the public and private sectors issue debt and securities. Furthermore, investment bankers often advise on transactions about mergers and acquisitions.

They work in a manner that helps businesses raise capital to achieve their growth goals. An investment banker makes more than $80,000 a year on average. Furthermore, when it comes to investment banking analysts, this number goes up to $90,000.

Security Trader

Security traders are a medium between the buyer and the seller. They help sell securities like shares or bonds to various potential buyers in the financial market. They do this either on their account or their employer’s account based on their level of expertise.

Security traders also assess the securities’ performance based on their stability or speculative tendencies. Their average salary per year is over $88,000.

Hedge Fund Analyst

The job of a hedge fund analyst is similar to that of an investment banker. The primary difference lies in hedge fund analysts managing high-risk and rewarding portfolios for investors who pool their capital to invest in hedge funds.

They have to monitor the markets to protect investors constantly. This makes the role of a hedge fund analyst extremely demanding. Top hedge fund analysts earn around $200,000 a year.

Private Equity Associate

Private equity associates are professionals that help investment firms create deals. They assist in finding potential investors, assist with acquired investments, and perform due diligence for existing customers of an investment bank.

Additionally, their duties include restructuring existing deals. Private equity firms come in all sizes, which leads to slight variations in the type of work these associates are involved in. They make $100,000 a year on average.

What Finance Career Involves The Stock Market?

A finance career can involve many aspects of the financial world, but one of the most common and well-known is the stock market. A job in the stock market can be fascinating and rewarding, but it also comes with many risks. If you’re thinking about a career in the stock market, here’s what you need to know.

The first thing to understand about a career in the stock market is that it is highly volatile. The stock market can go up or down at any time, and you could lose a lot of money unprepared. It’s essential to understand the risks before you get started.

Another thing to remember is that a stock market career requires a lot of research. You need to understand how the markets work and what factors can affect them.

Several careers involve the stock market; examples include the most prevalent being a stockbroker, who is responsible for handling customer transactions. A stockbroker must understand how stock markets function and be registered with the Securities and Exchange Commission (SEC). Another option is becoming a stockbroker.

An alternative is to become a securities sales agent; they handle sales for customers who wish to invest by considering their financial assets, such as stocks, bonds, mutual funds, portfolios, collections, etc.

Next, some private financial advisers help clients invest in the stock market with sound investment decisions. To earn this role, you need a postsecondary degree.

Finally, personal financial advisors aim to help clients make sound investments in the stock market. To pursue any of these careers, a bachelor’s degree is required in an appropriate field, like accounting, economics, or business. Also, getting certified by the Financial Industry Regulatory Authority (FINRA) is typically required.

Is Finance a Good Career Path For Students?

There are numerous internships and externships in the finance area. A single search on LinkedIn shows that there are more than 3.6K internships available in the USA that include the following jobs:

- Accounting Intern

- Tax Intern

- Audit Intern

- Summer Intern

- Finance Intern

- Claims Representative

- Actuarial Intern

- Tax Specialist

- Underwriter

- Property Specialist

Among the tops companies offering internships, there are:

- PwC

- Travelers

- Grant Thornton LLP (US)

- Carr, Riggs & Ingram

- CBIZ MHM, LLC

- Baker Tilly US

- Wipfli LLP

- CohnReznick LLP

- BerganKDV

- Baird

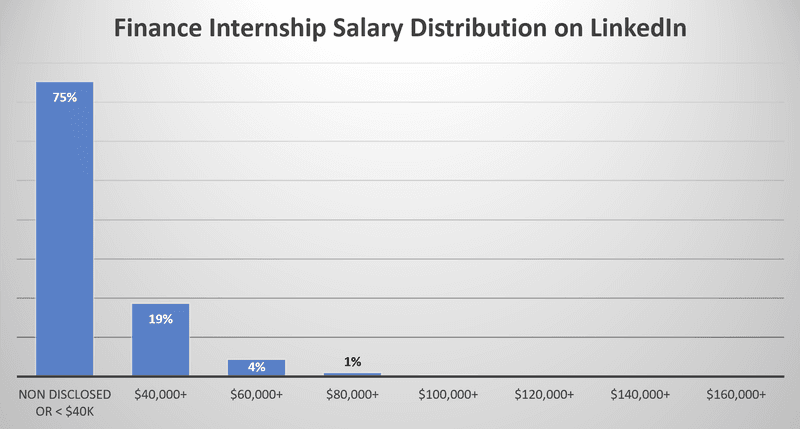

The salary distribution on LinkedIn shows that around 19% earn between $40,000 and $60,000. Glassdoor shows that the average finance intern job pays 56,633 /yr, starting from $30,000 and going up to $107,000!

After showing the number of jobs available, the high salaries, and the career as a future finance professional, we consider Finance a great career path.

Is Finance A Good Career Path?

When it comes to making career choices, finance often gets associated with long hours of work and high pressure. Working as a financial analyst or investment banker can be intimidating for many individuals seeking job security and flexibility in their professional lives. However, the big question remains: is finance a good career path? We then repeat our answer in the beginning:

Yes, Finance is widely regarded as an advantageous career path, offering a variety of prospects for growth and advancement. It is regularly perceived as the route to prosperity.

So, after all the reading, are you still considering a career in finance? It’s an exciting and ever-changing field full of potential. Finance professionals constantly work to be ahead of the curve, developing creative solutions for complex problems. But is finance a good career path? We explored critical points about this lucrative field to help answer that question.

Professionals in this field work with money and investments daily, gaining invaluable experience. From banks to corporations, financial institutions offer enticing salaries, benefits packages, and more—all while allowing talented individuals to hone their skillset daily. Plus, there are also specialized areas within finance, such as accounting or investment banking, where you can focus your efforts.

The answer to the query is yes if you are looking for tremendous growth opportunities. Also, one should not forget this is a highly lucrative path with many perks and that Finance professionals are always in demand.

However, this is a highly stressful field with extremely long working hours, and this is because one is constantly exposed to demanding clients and tight deadlines. This is also an area heavily influenced by external macroeconomic factors and the state of the economy.

Additionally, to maintain an edge in this field, employees must keep learning, which is highly taxing and continuously expensive.

If you want to know more about other career paths, check out this list on Totempool. You can make your choices with solid information before moving to a particular industry. If you want to learn how to choose your career path, check out this article.

Ranu Kumari is a Professional Writer and a Marketing enthusiast who currently runs her own Marketing Consultancy, LatitudeBOX. She has written promotional articles for multiple brands and has published her work in Scopus indexed journals. She is passionate about expressing her thoughts and ideas to connect with her readers in a voice that they understand.