Economics is one discipline that drives the world. This makes it extremely important to understand the concepts of economics. Also, these concepts form an essential part of our daily lives. In this article, we shall look at the marginal benefit in detail. Moreover, we shall focus on the relationship and difference between marginal benefit and marginal cost. So, let us dive in without much further ado.

Table of Contents

- What Is Marginal Benefit?

- How to Calculate Marginal Benefit?

- How to Find Marginal Benefit?

- Why Is the Demand Curve Referred to as a Marginal Benefit Curve?

- What Happens When the Marginal Benefit of an Output Exceeds the Marginal Cost?

- What Is the Difference Between Marginal Benefit and Marginal Cost?

- What is Marginal Private Benefit?

- What is Diminishing Marginal Benefit?

- What Does The Net Marginal Benefit Principle Stand For?

What Is Marginal Benefit?

Every choice that we make has pros and cons. When we use the word ‘marginal,’ it generally refers to one additional unit of something. The marginal benefit is the maximum amount a customer is willing to pay for an extra good or service.

In most cases, the marginal utility tends to decrease as the consumption of the good or service increases.

For example, a consumer is willing to pay $10 for one unit of chocolate. However, when it comes to the second unit of chocolate, the consumer may be willing to pay only $8. In this case, the marginal benefit of eating the chocolate is $10.

Now, the marginal benefit reduces from $10 to $8. The concept of marginal benefit explains why customers are willing to pay a specific price for goods and services.

How to Calculate Marginal Benefit?

Now that we know what marginal benefit is let us look at the method used to calculate this measure.

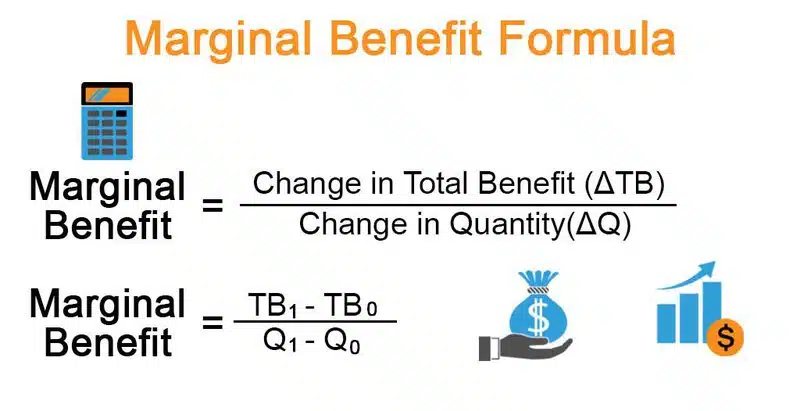

The formula for marginal benefit is arrived at by dividing the change in total benefit (ΔTB) by the difference in the quantity of the good or service (ΔQ). Mathematically, we can show it as:

Marginal Benefit = Change in Total Benefit (ΔTB) / Change in Quantity (ΔQ)

Also, there is another way to compute marginal benefit. We can show this as:

Marginal Benefit = (TB1 – TB0) / (Q1 – Q0)

where,

- TB0 = Initial Total Benefit at Quantity Q0

- TB1 = Final Total Benefit at Quantity Q1

- Q0 = Initial Quantity

- Q1 = Final Quantity

Example of Marginal Benefit Calculation

Let us make a minor modification to the chocolate example in the above section. Assume that a person is willing to buy five chocolates at $8 each. However, he wants to buy another set of 10 chocolates at $4 each. The question is, will the person buy all 15 chocolates at a 15% discount?

Here the initial quantity at no discount, Q0, is 5.

- Final Quantity at 25% discount Q1 is 15

- Total Bill at no discount TB0 is $40

- The total Bill at a 15% discount is $102

- Marginal benefit is = (102-40) / 15-5

- = 62 / 10 = $6.2

Since the price of the next set of chocolates is $6.2, which is higher than $4, which is what the consumer is willing to pay, he will not buy the next set of chocolates.

Explanation of the Marginal Benefit Formula

Here are the steps to calculate the marginal benefit formula:

Step 1: Determine the starting quantity of the commodity or service consumed and the total benefit the consumer derives from it. A consumer’s willingness to pay can be used as a proxy for full benefit. Q0 and TB0 stand for the beginning quantity and real benefit, respectively.

Step 2: Determine the final quantity of the items or service consumed, as well as the total amount of money the consumer is willing to pay for that quantity, which is denoted by Q1 and TB1, respectively.

Step 3: Next, compute the change in total benefit, which is the final real benefit (step 2) minus the change in full benefit.

Change in Total Benefit (ΔTB) = TB1 – TB0

Step 4: Next, compute the change in quantity consumed, which is the final quantity (step 2) minus the initial amount (step 1).

Quantity Change (Q) = Q1 – Q0

Step 5: Finally, the marginal benefit formula can be calculated by dividing the change in total benefit (step 3) by the change in quantity (step 4), as shown below.

Change in Total Benefit (TB) / Change in Quantity (Q) = Marginal Benefit

(TB1 – TB0) / (Q1 – Q0) = Marginal Benefit

How to Find Marginal Benefit?

Now that we understand the formula, let us look at the process to find the marginal benefit.

Identify Current Sales

The first step in calculating marginal benefit is to determine a product’s current daily sales. Once you’ve determined how much money a product makes in sales, you can consider what price point would entice people to buy another product.

For instance, a lemonade stand sells a glass of lemonade at $4. The cost of the lemons and the plastic glasses is $2. Now, if the seller manages to sell 200 glasses a day, then the current earnings of the stand are $400.

Promote New Offers

Undertake market research and compare your competitors’ pricing for an extra cup of coffee to calculate the marginal benefit for your customers. Promote this new offer on your menu to help increase customer awareness and mind share.

In the above example, after reviewing the prices of the neighboring stand, the seller decides to give an extra glass of lemonade at $3. This still gives him a profit of $1.

Also, he advertises that every person who purchases one glass will get the second one at a discount.

Assess Customer Satisfaction

Examine the daily sales that the additional unit generated at a lower price. If you are dissatisfied with the profit, consider lowering the price even further.

Continuing with the above example, let us say that the additional glass of lemonade led to a total of 400 sales. With $1 as the seller’s profit, his total earnings are $400. So, he decides to encourage people to buy another glass of lemonade.

Refine Offer

If the current marginal benefit did not generate enough customer sales, consider lowering the price of the offer. It would be best if you still considered production costs and profit potential.

In the above instance, the seller believes that more money will be made if each glass of lemonade is sold at $2.75.

Determine Marginal Benefit From Increased Sales

If a company sees a significant boost in sales after re-pricing a product at a lower price point, it might establish that this is a marginal benefit for the customers.

After this new offer, the lemonade seller sees that the sales have increased to 800 orders per day. Also, this means that the daily profits now are 0.75 *800 = $600. The marginal benefit, in this case, for every additional glass is 75 cents.

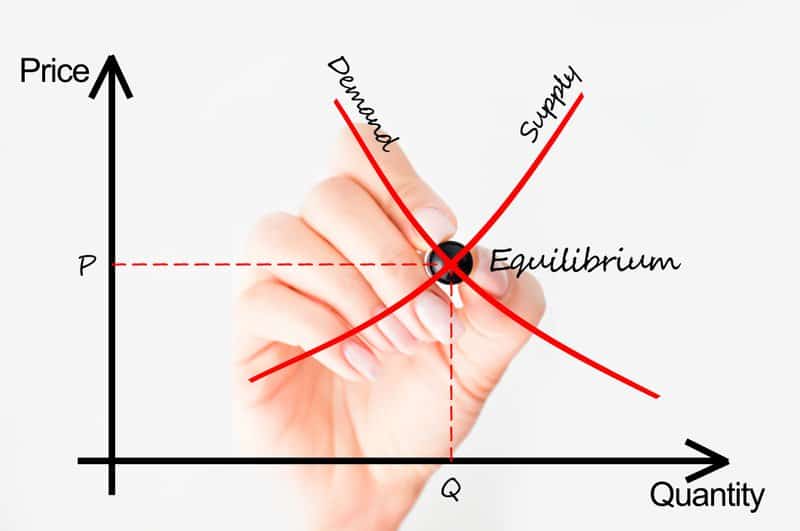

Why Is the Demand Curve Referred to as a Marginal Benefit Curve?

The demand curve is a line graph that shows the relationship between quantity and price.

It depicts the different quantities of a good or service that will be purchased at different prices. The price points are along the Y-axis, whereas the amount is along the X-axis. Generally, if all other factors remain the same, the quantity demanded will decrease as the price increases.

Also, the demand curves can shift with changes in external factors such as incomes and preferences. An increase or decrease in demand causes these shifts to the right and left of the original demand curve.

Now generally, people view the demand curve as price driving quantity. That is, as the quantity demand decreases, there is an increase in price and vice-versa. That is, to view it as quantity driving price. However, let us see how things change if the same curve is viewed differently.

Let us say we make cars. Instead of saying how many cars we will sell at $50,000, we will tell how many cars we will sell if we only make one car weekly.

Now, the more units of a particular good that one consumes, the more benefits he will get. However, the marginal benefit goes down with each extra unit consumed. So, because of this negative correlation, the demand curve or the marginal benefit curve has a downward slope.

Since the demand curve measures the marginal benefit of each additional unit, the supplier should not produce anything beyond the demand curve as they will impose a marginal cost rather than a marginal benefit.

What Happens When the Marginal Benefit of an Output Exceeds the Marginal Cost?

One needs resources such as labor to create any product. Now a business cannot increase working capital in the short run. So, it decides to increase the number of workers. However, hiring more people does not directly correlate with the output beyond a certain point.

Assume you own a cabbage farm and only have one truck to transport the cabbages to the market where they are sold. You may hire someone to dig up the cabbages, wash them, and transport them to the market.

Now, let us look at the scenarios as you go ahead and hire more people to work on your farm. When you work alone, you have to switch jobs frequently, spending a lot of time.

When recruiting your first employee, one of you may dig up cabbages while the other washes them and transports them to the truck for sale.

Two diggers and two washers may operate with four laborers while you run the truck.

This works well — with your first four workers, each person improves the overall efficiency of the operation, and the truck is now being utilized full-time.

When you start recruiting additional workers, your truck will soon be unable to carry and transport all of the cabbages, and people will have to wait for you to return and reload.

Because you can’t speed up the truck, the more people you add to the labor force, the more time you’ll wait. When workers are waiting, it implies you’re paying them while doing no extra work, making everyone less productive.

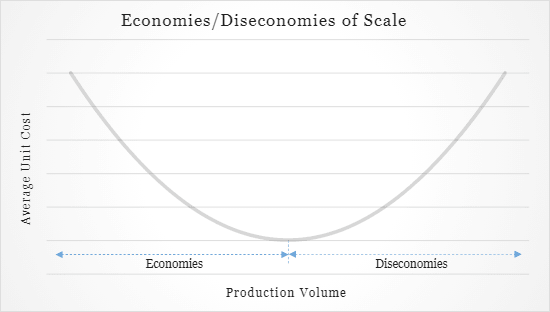

Economies of Scale

As you start to hire more people to work on your farm and the average cost keeps decreasing, this phenomenon is known as ‘Economies of Scale.’ However, when you hire workers beyond a certain threshold and people are waiting to use the truck, the average costs start to increase. This is known as ‘Diseconomies of Scale.’

If the marginal benefit is higher than the marginal cost, you will profit more when you produce and sell one extra unit.

What Is the Difference Between Marginal Benefit and Marginal Cost?

Firms need to know the difference between marginal benefit and marginal cost. This will help formulate better plans and marketing strategies for their products.

Also, maintaining a balance between marginal cost and marginal benefit is essential for a sustainable business. Here, we explore the relationship between marginal cost and marginal benefit.

Marginal Cost

This is the measurable change in cost that occurs with each additional unit produced. There are several types of marginal costs. These are:

Unit Costs: These are costs that lead to overall cost increases. Examples are material and supply costs.

Batch Costs: These depend on production batches rather than individual units. Batch costs are dependent on material and supply costs. Firms might use specific equipment more to produce more batches and incur fewer costs.

Product costs: The costs for designing a product and taking it to the market are known as product costs.

Customer Costs: Customer service and customer relationship cost fall under this category.

Organizational Costs: Operational costs such as salaries are part of organizational costs.

Now, the formula for marginal cost is:

Marginal Cost = Change in Cost / Change in Quantity

Types of Marginal Benefits

Similar to marginal costs, there are different types of marginal benefits as well. Let us have a look at them below:

Positive Benefit: A person who likes candies might experience more happiness on getting a second candy.

Negative Benefit: A lot of the same products can have the opposite effect. In the above example, too many candies will not add to his joy. He might feel sick instead.

Zero Benefit: This happens when the consumer neither gains happiness nor experiences dissatisfaction. A person might stop eating or buying candies when he feels he has had enough.

When consumers pay less while buying additional products, profits will increase if the marginal costs are low. However, the profits will decrease in case the marginal costs are high.

What Happens When Marginal Benefit Equals Marginal Cost?

One can achieve market efficiency when marginal benefit equals marginal cost. The quantity of goods produced is precisely what the customers want. Also, the overall profit maximizes when marginal benefit equals marginal cost.

What is Marginal Private Benefit?

Marginal Private benefit is an economic term that refers to the increase in benefit a person receives when they consume one more unit of a good or service. It can be thought of as the extra enjoyment or satisfaction an individual gets from consuming one additional item. Understanding Marginal Private Benefits can help businesses better understand how consumers make decisions when purchasing products and services.

Understanding the concept of Marginal Private Benefit is essential for business owners and economists alike. Businesses need to know what drives customers to purchase their goods and services, while economists use this concept to explain why people are willing to pay certain prices for items. This knowledge can also help governments determine whether or not markets are functioning efficiently by gauging consumer preferences.

What is Diminishing Marginal Benefit?

Diminishing marginal benefit (DMB) is an economic concept describing how a consumer’s satisfaction decreases as they consume more of a good or service. DMB states that with each additional unit consumed, the utility gained by the consumer lessens. This means that although consumers may want more of a particular product, their enjoyment begins,s to diminish after a certain point, and they no longer get as much satisfaction from purchasing it.

Understanding diminishing marginal benefits can help businesses better understand their customer’s behavior and needs when pricing products and services. Knowing this concept can also help companies identify areas where they can increase customer satisfaction by changing their offerings to maximize the benefits of each purchase. By understanding diminishing marginal benefits, businesses can create products and services that will meet customers’ needs while providing them with maximum utility for their money.

The net marginal benefit principle is essential for anyone interested in economic policy. It stands for the idea that when considering any economic decision, we should consider the benefits of a particular action minus its costs. It’s a crucial part of modern economics and has implications for public policy decisions such as taxation and market regulation.

What Does The Net Marginal Benefit Principle Stand For?

In short, the net marginal benefit principle means that any action taken should be weighed regarding its potential positive and negative effects. That is, if the benefits outweigh the costs,, then it would be wise to pursue this course of action – but if not,, it might be better to look at different options. This is a handy way to analyze economic situations, helping us make more informed decisions about allocating resources efficiently and effectively.

In Conclusion

Marginal benefit is an important metric. This is because it helps firms decide their costs and production strategies. With marginal benefit in mind, companies also know how many units of each product to make. Also, this measure is essential for consumers. It helps them decide the acceptable prices for various goods and services.

Ranu Kumari is a Professional Writer and a Marketing enthusiast who currently runs her own Marketing Consultancy, LatitudeBOX. She has written promotional articles for multiple brands and has published her work in Scopus indexed journals. She is passionate about expressing her thoughts and ideas to connect with her readers in a voice that they understand.

This is a great post! I’ve been trying to calculate marginal benefit for a while now and this article has really helped me understand it better.