You have heard a lot about the performance bonus, but nowadays, the retention bonus is quite common as well. Employees are the heart and soul of any organization so all the goals and objectives that any firm wants to accomplish boil down to people management. It is essential that they retain talented, experienced, and driven employees.

However, there are times when there is an unprecedented demand for talent and resources across all industries. This is when it is common to notice people switching jobs in lieu of better compensation, titles, and other benefits.

This has given rise to a practice where firms pay some of their existing top employees a retention bonus to make them stay. Also, it helps firms maintain an edge in the war for talent.

The phenomenon of a retention bonus is exactly what we are going to discuss in this article.

What Is a Retention Bonus?

While running a business, firms often need a tool or an incentive that can convince key employees to stay with the company. One such incentive is the retention incentive. This retention bonus is typically offered when firms are undergoing a transition period.

Examples of such periods are a merger or an acquisition. A retention bonus is usually a one-time lump sum payment. However, the company can also pay in parts over a given period.

The retention bonus is in the form of a contract. This contract usually details how long the employee must stay with the company in exchange for the promised sum of money. Generally, retention bonuses are a significant amount. Usually, they can range anywhere from 10-25% of your base pay but sometimes even more.

How Do Retention Bonuses Work?

A retention bonus is unrelated to your performance at the workplace or in a particular role. This bonus is not meant to retain people over an indefinite period.

A firm must decide on its reasons for giving an employee a retention bonus. This can also help determine the amount that the firm must pay. If the sole purpose of the retention bonus is to prevent people from switching to the competition, then the bonus must match the competing offer.

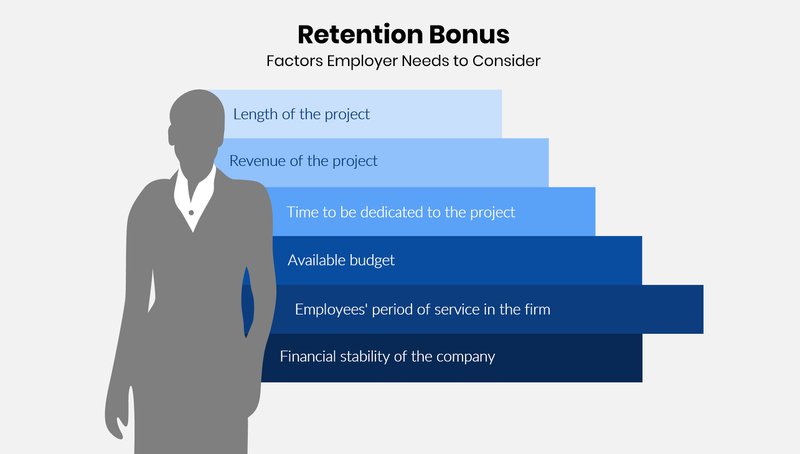

However, there may be a situation where the employer wants to stop its key team members from leaving before they complete a project. In such a scenario, the employer will have to consider various factors such as :

- The length of the project

- The revenue of the project

- The time the retained employee has to give to the project

- The budgets available with the concerned department

- Employees’ period of service in the firm

- Financial stability of the company

Retention bonuses are pretty common in large firms with more than 20,000 employees. These big companies usually have the resources to retain critical employees.

Is Retention Bonus Classified as Income?

The IRS considers all forms of bonuses, including retention bonuses as supplemental income. Now, the supplemental wage is basically compensation in addition to an employee’s regular wages.

Taxation, in this case, usually takes place in one of two ways – the aggregate method or the percentage method.

Any retention bonus is a part of one’s gross pay and must be reported for tax purposes. In most cases, the aggregate tax method leads to more tax because the aggregate tax adds the retention bonus to the yearly salary.

The final tax is then calculated on this salary. A W-4 form is used to calculate the tax rate. However, the exact tax depends on the actual bonus.

A flat rate of 25% applies to the bonus in the percentage tax method. However, if the bonus is in excess of a million dollars, then the taxation rate for the amount above million dollars is 39.6%.

For instance, if a person receives a bonus of 1.5 million dollars, then 1 million dollars would be taxed at 25%, and 500,000 dollars would be taxed at 39.6%

How to Decide if You Should Accept a Retention Bonus?

When a company has offered you a retention bonus, it means that the firm values your contribution. Now you must decide whether he wants to accept the bonus or not.

This depends on various factors that are detailed below:

The reasons a firm offers a bonus.

A firm might extend a retention bonus for several reasons. They would like to ensure stability as the firm goes through leadership or structural changes. Or, they might not want to lose quality talent to the competition.

However, you have to use your discretion and conclude whether you agree with the company’s rationale.

A person’s experience at the firm.

You have to assess whether the current work motivates you or not. Also, you have to see if your career progression aligns with the overall company’s goals. Moreover, there is the question of cultural fit. Is your overall personality more in line with the current organization ? Collaborative work culture is a crucial driver of job performance.

The current job market and industry scenario.

Based on your skillsets, you should study the current demand in the industry.

You can gauge how easy or difficult it would be to find a suitable job role. This clarity will go a long way in helping you decide whether to accept a bonus or not.

Taxes

We have already discussed the taxation structure for bonuses. Ultimately, it is upon you to decide whether a retention bonus would be beneficial to you. You can reach out to a tax consultant to discuss this matter.

Based on the feedback, you can decide whether to opt for a bonus or ask for a raise.

Pros of Retention Bonus

There are several pros to giving or receiving a retention bonus to employees. We will explore them in detail here.

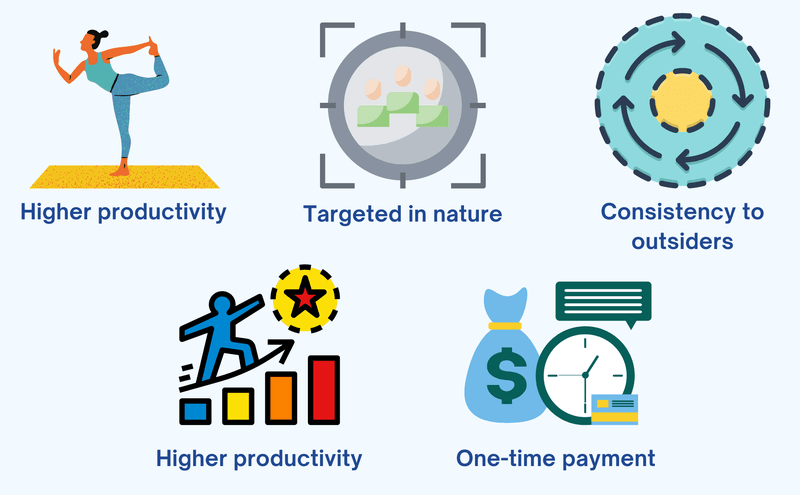

Higher productivity

Even though retention bonuses are not connected to an employee’s performance, they still add to the feel-good factor and encourage employees to work harder.

Targeted in nature

A retention bonus is only for specific individuals, meaning that the company has already identified a select group as valuable assets. This, in turn, increases your motivation to work harder. The reason is that the company has rewarded its unique contributions, which includes you!

Consistency to outsiders

Retaining top-level executives and other key employees during a transition period is a sign of strength for the company. Also, it signals to the investors and other stakeholders that things are moving smoothly, which helps maintain the investors’ confidence

It is a morale booster

There could be times when the industry or the firm is going through a crisis. Financial rewards are one of the best ways to show appreciation. A retention bonus is a great way to show that the firm values its employees. Also, it will motivate employees to upskill themselves further.

One-time payment

From the employer’s point of view, a retention bonus is a one-time payment to a select few. This helps him keep the costs under control compared to a pay raise. Also, the team performance improves. Thus, it is a win-win situation.

Cons of Retention Bonus

Despite all the plus points, there are downsides to a retention bonus. We shall look at those disadvantages here:

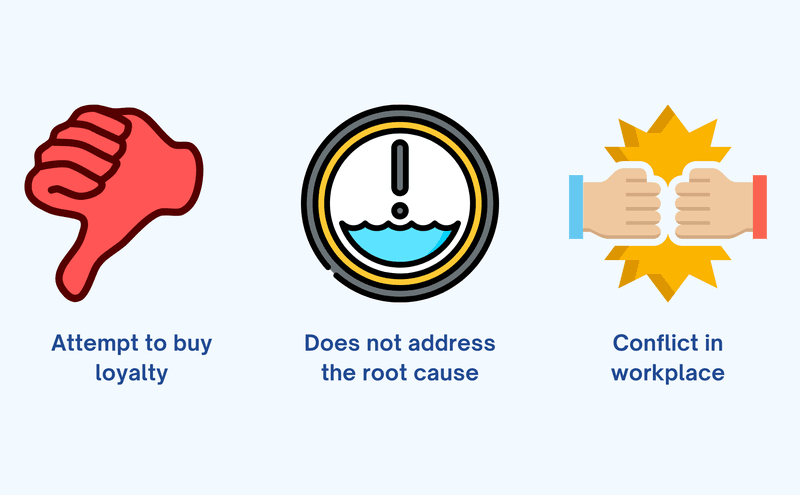

Attempt to buy loyalty

Some employees might feel that they are valued only when they handed in their resignation. Also, the employees can view it as a last-minute rescue effort to steady a sinking ship. A retention bonus could then have the opposite effect and cause more people to leave the team.

Does not address the root cause

There might be issues such as toxic work culture or unresponsive management. A retention bonus is a quick fix that might reduce the discontent temporarily. However, it does not solve the issues of employee dissatisfaction. If you are demotivated, most probably pocketing some money won’t help you improve your performance.

Conflict in the workplace

The fact that some people have received a bonus, and others have not, will make its way through the grapevine. This will then create discontent amongst the staff. The result of this exercise will be a toxic office environment with a demotivated workforce.

The Retention Bonus Negotiation

When it comes to offering or accepting a lucrative retention bonus, you’ll want to think about how the bonus will make up for the cost of hiring someone new. A great way to do this is to negotiate your retention bonus as a part of the company’s cost for that. This can help you come up with a fair figure.

For example, if a new hire would make 6-figure salary, around $200,000, and the company is paying the recruiter 20% of his or her annual salary for the hire. Then, there is a space around $40,000 to negotiate.

Continuing the example, if the company offers you 10% yearly salary for the next two years, they would pay $40,000 in advance, totalizing the 20% they would spend with a new hire. You get the picture. You would receive in advance and would return proportionally to the company in case you leave before two years.

These bonuses often vary between organizations but may include anything from equity grants or additional benefits like a company car.

How Much Is A Retention Bonus?

It can vary a lot. The amount of a retention bonus depends on the company and your job seniority, but it generally falls in the range of five to ten percent of your annual salary. Some companies may offer bonuses as high as 15-20 percent.

How To Negotiate A Retention Bonus

The company has offered you a retention bonus. And now what?

When it comes to negotiating a retention bonus, it is important to remember that the purpose of the bonus is to keep you with the company. As such, the negotiation process should be focused on achieving a fair outcome for both parties.

The first step in the negotiation process is to understand what factors were used to calculate the bonus. These factors can include the length of time you have been with the company, your performance to date, and how crucial your position is to the company. Once these factors have been determined, it is time to start negotiating.

The next step is to read the initial offer. It is important to remember that the company wants to keep you, so don’t be afraid to ask for what you think you deserve. However, you should also be realistic about your expectations.

Once you have read the initial offer, it is time to discuss it with the company. During this discussion, you should be prepared to ask key questions about your future career there.

For example, if the company is willing to give you a bonus for three years, ask if they are willing to also offer salary increases based on your performance. You don’t want to be with the same salary for three years if you have an outstanding performance.

Once you’ve agreed, get everything in writing so there’s no confusion later on.

What Is A Retention Bonus Agreement?

A retention bonus agreement is a document that outlines the specific terms of the retention bonus. These agreements vary depending on the type of company, industry, and size.

While they can be drafted by management and signed off by HR or legal teams, it’s always best to work with an attorney who has experience in this area.

In Conclusion

The final decision to accept or reject a retention bonus lies with the employee. However, it is essential to know that a retention bonus is not a silver bullet that will resolve your concerns.

This decision to move on or stay in an organization or a role is entirely dependent on several factors. There may be an interesting situation where several employees look for more fulfilling roles rather than a larger pay packet. This is when even a retention bonus might not help the employer in retaining the talent.

Also, you must not forget the employer’s thought process on this. He has to choose between infusing young blood and fresh thoughts and keeping seasoned people on board.

The fact of the matter is that every employee, whether seasoned or new has to stay relevant, at all times, in order to receive such incentives.

If the employees are insistent on leaving the organization, then an employer has to think hard about whether a retention bonus is a worthwhile investment or not.

Ranu Kumari is a Professional Writer and a Marketing enthusiast who currently runs her own Marketing Consultancy, LatitudeBOX. She has written promotional articles for multiple brands and has published her work in Scopus indexed journals. She is passionate about expressing her thoughts and ideas to connect with her readers in a voice that they understand.